Am I on the right track for retirement?

It’s an easy question. however to answer it accurately and ensure you don’t outlast your cash, you need powerful data and high-level maths. And, even then, a leap of faith.

|

Matt Fellowes

Source: United Income

|

The answer you sometimes get from financial advisers is to save as much as possible, or far more than you'll ever spend, and hope for the most effective. The result's staff scared to retire and retirees terrified to spend a dime on something fun or frivolous .

Now comes United income, a new money manager backed by some of the largest names in retirement, pitching massive data as a solution. It’s deploying huge sets of stats on investment performance, retiree spending, longevity, and different crucial factors to simulate uncounted outcomes. The software package estimates the chances that each client’s personalised retirement strategy will actually succeed, then refines the plan if it won’t, based on as many as eighteen million simulations per consumer, UI said. The aim is to create retirees’ cash go lots additional than alternative planning software package, that Founder and CEO Matt Fellowes scorns as hopelessly out of date.

“We’ve invented a new approach to cash management,” Fellowes said in an interview.

That may sound familiar, but Fellowes, 42, has some street cred. A member of the family that owns Fellowes Brands, a 100-year-old conglomerate, he’s a former Brookings institution scholar. In 2009, he started HelloWallet, which companies hire to offer financial facilitate to workers. Morningstar inc. acquired it in 2014 for $52.5 million, and Fellowes became the investment analysis giant’s chief innovation officer. Now, Morningstar helps to back United income, with more than a 3rd of the $5.8 million raised so far. The new firm formally opens to investors nowadays.

“It’s a bet on Matt, and that he can build an exceptional team to tackle a extremely difficult investor problem,” said Joe Mansueto, Morningstar’s founder and chairman. “It’s a business chance, however it’s also a way to improve the retirement of a lot of Americans.”

Basic retirement calculators just do math, estimating however cash might grow over time. The more sophisticated calculators use historical market data to game out the best- and worst-case scenarios for investment performance.

United income does that, too, but Fellowes stresses the numerous “future life outcomes” it models. By focusing on investment, he argues, alternative firms ignore the 2 most important queries in retirement: when ar you about to die, and how much ar you going to spend before you do?

To get the answers, United income, whose eighteen regular workers ar based mostly in Washington, D.C., got advice from prominent people in policy and investment circles. J. Mark Iwry, a key architect of retirement policy within the Obama administration, is listed as an advisor, along with stephen Utkus, director of Vanguard Group’s Center for investor Research; John Wider, a former president and CEO of aarp Services, a wing of the retired person organization; {and several|and a number of other|and several other} other former government officials. 1

Health, exercise, and, progressively, education and socioeconomic status can help predict however long we live. even as the common American’s longevity has stalled, there ar affluent, educated fitness freaks who should probably plan on hitting a hundred. United income asks clients regarding these factors and so uses detailed actuarial tables to estimate longevity. It does the same for spending, tapping government data to plot out however people might actually consume over the course of their retirements.

“Everybody’s spending curve is completely different,” Fellowes said. spending on essentials tends to stay the same throughout retirement and should even decline—for example, if retirees pay off their mortgages. but discretionary spending, like touristry, tends to spike at the beginning of retirement. Health care spending, although essential, is usually targeted at the end. Your spending pattern is additional affected by your marital status, financial situation, health, and other factors.

United income crunches all these data and makes recommendations. It provides recommendation on the most effective times to take Social Security payouts and build taxable retirement plan withdrawals, and builds and manages custom investment portfolios using low-priced exchange-traded funds. The key to creating nest eggs go further, Fellowes said, is an automatic, sophisticated investment strategy based on every client’s estimated requirements.

For example, your essentials, like utilities, groceries, and mortgage payments, should be covered with ultra-safe sources of income like Social Security, pension payments, annuities, or conservative, bond-heavy investments. That lets you take additional risk, and in theory get higher returns, with cash you’ve put aside for other goals, which clients will customise. cash for an around-the-world trip might go in an aggressively risky, equity-heavy portfolio. The strategy for a granddaughter’s college fund can depend upon how shortly the girl graduates from highschool. money for major health care expenses, which frequently occur later in retirement, can start out in risky investments and move to safer ones over time.

|

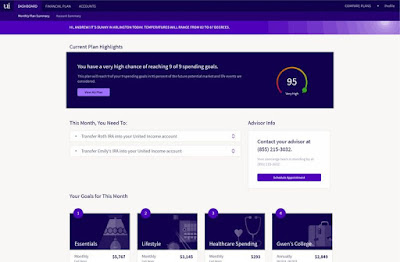

| United Income's dashboard page Source: United Income |

“All those rules of thumb created sense in a world that could not personalise data,” Fellowes said. “They simply don’t make sense anymore.”

As a result, he said, retirees ar often told to invest too conservatively. A 70-year-old with a modest life style might need most her essentials covered by Social Security or a guaranteed pension. that provides her a lot of freedom to invest sharply, to build up a fund for late-in-life health care, and even to splurge on the occasional luxury.

United Income’s approach could be a big step forward in retirement planning—if its models work.

“The challenge is execution,” Mansueto said. Fellowes has “got nice concepts, but there’s a reason that it hasn’t been solved yet.”

United income will have to get each detail right. Its main target is people between fifty five and seventy with $300,000 to $3 million to invest. a plan that succeeds for these clients nine times out of ten will still fail an unacceptable range of people.

“When you’re giving investment advice, the guideline is ‘do no harm,’” said Anthony Webb, director of research at the Schwartz Center for policy Analysis at the New school for Social analysis. Webb hasn’t reviewed United Income’s methodology but warns of the difficulty of making custom-made retirement plans that employment for everybody. you'll try and estimate a client’s longevity, for instance, however even with major health issues he or she still has a little likelihood of living to a very adulthood. you have to hedge that risk, he said.

One way is to suggest insurance product. United income doesn’t but is exploring adding easy annuities and deferred annuities, also known as longevity insurance, to its platform.

lients will monitor their plan’s risk of failing in real time. when they go browsing, they’re greeted by a meter gauging “our confidence that this plan will succeed” and told how many of their disbursal goals ar still on track. Don’t expect that confidence range to waver much, though, Fellowes said, even though the stock market plunges twenty % in one day. The calculations ar based on all the factors that move into UI’s models, spread out over the rest of a client’s life.

United income charges an annual fee of 0.5 to 0.8 % of assets, depending on the level of service clients need and how much cash they invest. (UI also offers a financial plan and Social Security recommendation for free of charge.) It also keeps track of money and investments held with other institutions and takes those assets into account once creating recommendations. ahead of its official launch, United income said it's collected more than $200 million in assets since late july.

Why haven’t additional monetary corporations amped up the info piece of their retirement-planning tools this much? It’s arduous. For younger staff getting ready for retirement, everyone’s goal is just about identical, to avoid wasting and invest the maximum amount as they'll. however when age fifty five, the quality recommendation doesn’t work in addition and subjective measures matter additional. what quantity does one like your job, and the way secure is it? wherever does one need to live? How’s your health?

Another reason several retirees don’t get subtle advice: scores of corporations attempt arduous to sell shoppers a open-end investment company or associate degree regular payment to reap a commission, however when the sale is complete they’re abundant less fascinated by their day-after-day cash management wants.

That gives United financial gain a chance, if shoppers realize its recommendation valuable. which might place even additional pressure on the nation’s incumbent monetary advisers, already facing fast modification and progressively hard shoppers United Nations agency have sensible reason to be skeptical of their recommendation.